Pre-Construction Vs. Resale: Which Is A Better Investment? Investing in real estate offers numerous opportunities for financial growth, but navigating the market requires careful consideration of various factors. One crucial decision investors face is choosing between pre-construction properties and resale properties. Both options come with their own set of advantages and disadvantages, making it essential to weigh them against each other to make an informed decision.

Defining Pre-Construction and Resale Properties

Pre-construction properties refer to units or developments that are sold by developers before they are built or completed. On the other hand, resale properties are existing homes or units that have been previously owned and are being sold by their current owners.

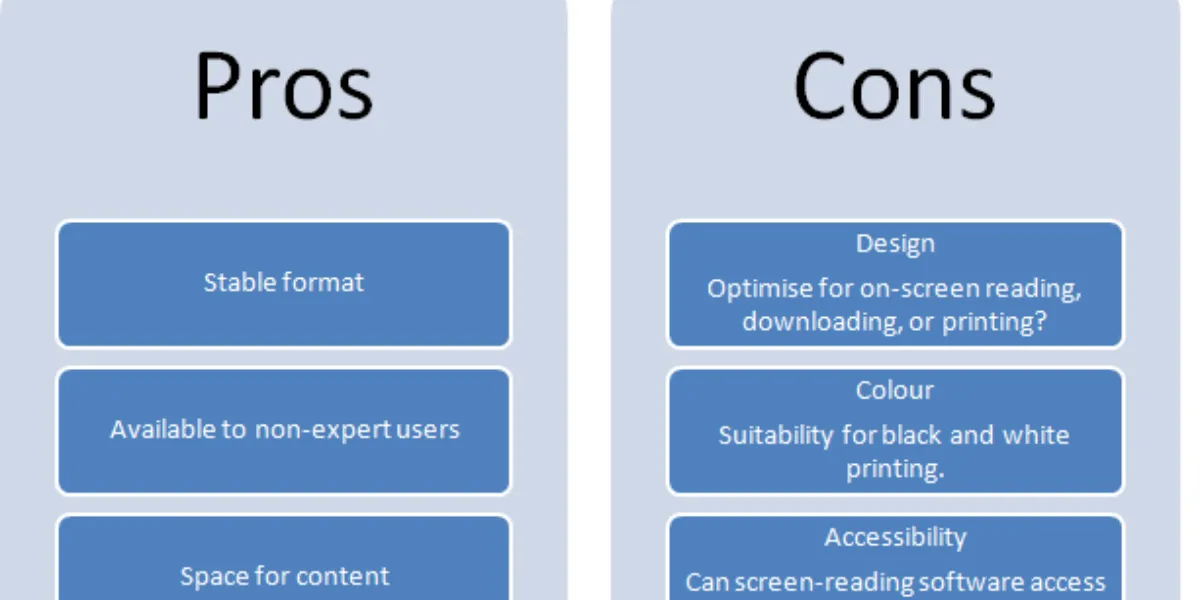

Pros and Cons of Pre-Construction Investments

Pre-construction investments offer the advantage of buying at a lower price compared to resale properties. Additionally, investors may have more customization options and the potential for higher appreciation as the property is brand new. However, pre-construction investments come with risks such as construction delays, changes in market conditions, and the possibility of the final product not meeting expectations.

Pros and Cons of Resale Investments

Resale properties provide the benefit of immediate occupancy and the ability to inspect the property thoroughly before making a purchase. They also offer a clearer picture of the neighborhood and surrounding amenities. However, resale properties may come with higher upfront costs and limited customization options compared to pre-construction investments. Additionally, they may require renovations or updates, adding to the overall expenses.

Financial Considerations: Costs Associated with Pre-Construction vs. Resale

Investors should consider the financial aspects of both options, including the initial investment, financing options, and ongoing expenses such as maintenance fees and property taxes. Pre-construction properties may require lower initial deposits but can involve additional closing costs and potential increases in construction costs. Resale properties may have higher upfront costs but fewer uncertainties regarding final expenses.

Timing and Market Conditions: Impact on Investment Decisions

Market conditions play a significant role in determining the suitability of pre-construction or resale investments. In a seller’s market where demand outweighs supply, pre-construction properties may offer better opportunities for appreciation. Conversely, in a buyer’s market where inventory is high, resale properties may be more attractive due to competitive pricing and negotiation leverage.

Risk Assessment: Evaluating Risks in Pre-Construction and Resale Investments

Investors must conduct a thorough risk assessment before committing to either pre-construction or resale investments. Risks associated with pre-construction properties include construction delays, financial instability of developers, and changes in market dynamics. Resale properties may carry risks such as hidden defects, market fluctuations, and potential legal issues.

Potential Returns: Analyzing ROI in Pre-Construction vs. Resale Properties

Calculating potential returns is essential for assessing the profitability of real estate investments. Pre-construction properties may offer higher appreciation potential over the long term, especially in rapidly growing markets. Resale properties may provide immediate rental income or shorter holding periods for flipping, resulting in quicker returns on investment.

Location Matters: Importance in Pre-Construction and Resale Investments

The location of a property significantly influences its value and investment potential. Whether investing in pre-construction or resale properties, factors such as proximity to amenities, transportation hubs, schools, and employment centers should be carefully considered. Researching local market trends and future development plans can help identify promising locations for investment.

Legal Considerations: Contracts, Rights, and Responsibilities

Both pre-construction and resale investments involve legal contracts and obligations that investors must understand fully. In pre-construction purchases, investors should review the developer’s track record, contract terms, and warranty provisions carefully. Resale transactions require thorough due diligence, including title searches, property inspections, and understanding homeowners association rules and regulations.

Tax Implications: Understanding Taxation in Real Estate Investments

Investors should be aware of the tax implications associated with both pre-construction and resale properties. Tax laws may vary depending on factors such as rental income, capital gains, and property depreciation. Consulting with a tax professional can help investors optimize their tax strategies and minimize liabilities.

Personal Preferences: Tailoring Investment Choices to Your Needs

Ultimately, the decision between pre-construction and resale investments depends on individual preferences, goals, and risk tolerance. Some investors may prioritize potential appreciation and customization options offered by pre-construction properties, while others may prefer the stability and immediate benefits of resale properties. Considering personal circumstances and long-term objectives is crucial in making the right investment choice.

Making Informed Investment Decisions

Choosing between pre-construction and resale properties is a significant decision that requires careful analysis and consideration of various factors. By weighing the pros and cons, assessing financial implications, understanding market conditions, and evaluating personal preferences, investors can make informed decisions that align with their investment goals and objectives. Whether opting for pre-construction or resale, thorough research and due diligence are essential for maximizing returns and mitigating risks in real estate investments.

Click here for more visited Posts!

Join The Discussion